How Gold Royalty Companies Work

How Gold Royalty Companies Skim the Cream of the Mining Business

Gold royalty companies don’t mine for gold—they let others do the heavy lifting while they collect a slice off the top. They’re financiers, portfolio managers, and gold-market whisperers rolled into one. And they’ve carved out a unique niche in the mining industry. But how does this business model work? And why does it appeal to investors?

Let’s dive in.

What Are Gold Royalties, and Why Do They Matter?

When a mining company wants to develop a property but needs funding, they will often sell a royalty—an agreement where the buyer gets a percentage of future revenue or production. For the royalty company, this means a one-time investment for a potentially lifelong income stream.

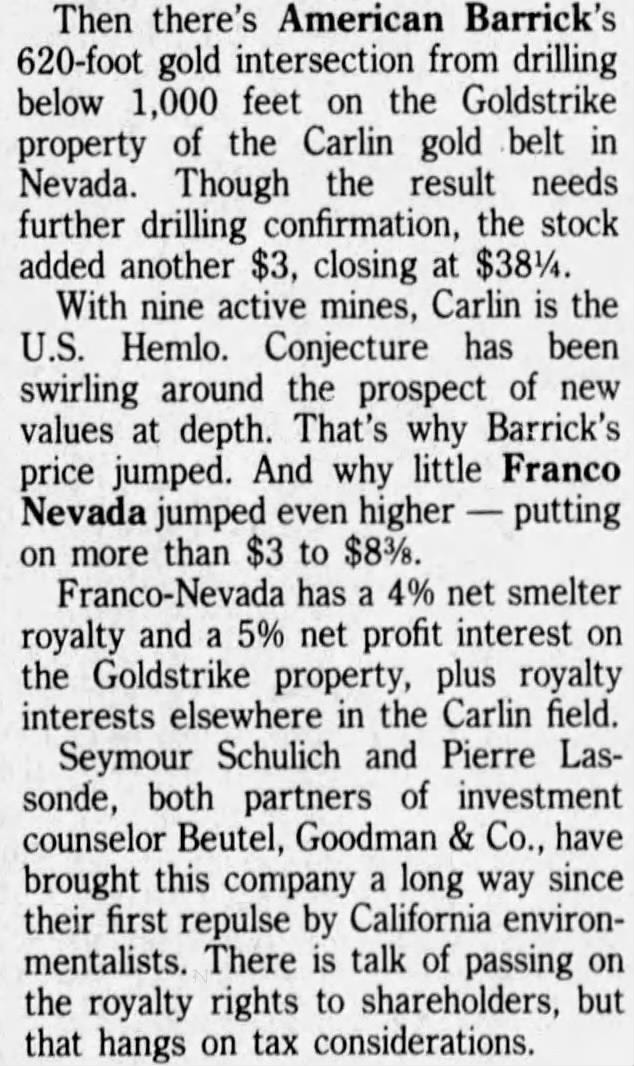

The modern royalty company model emerged in the 1980s with Franco Nevada. Founders Seymour Schulich and Pierre Lassonde revolutionized mining finance by investing $2 million for a 4% royalty on the Goldstrike Mine. That mine, now part of Barrick’s Carlin Complex, has since produced over 50 million ounces of gold. Franco Nevada’s original investment has yielded consistent payments for decades—all without the headaches of operating the mine.

How Royalty Companies Avoid the Pitfalls of Mining

Mining is a capital-intensive, high-risk business. Operators constantly battle rising costs, reserve depletion, and political risks. To fund exploration or production, mining companies dilute shareholders by issuing new equity.

Here’s an example: Suppose an investor owns 42% of a mining startup. Over ten years of raising capital, that stake might shrink to less than 1%; even if the mine becomes profitable, the dilution limits upside potential.

Royalty holders sidestep these risks. They’re entitled to a share of mine revenue regardless of operating costs, dilution, or ownership changes. Whether the mine changes hands, faces economic troubles, or gets entangled in bankruptcy, the royalty remains intact.

However, less risk means less reward. A royalty typically yields lower returns than owning the mine outright, but it’s far more predictable. Franco Nevada’s Goldstrike royalty, for example, generates about $20 million annually—steady income without operational headaches.

The Strategy Behind Royalty Portfolios

Gold royalty companies diversify by acquiring interests in projects across various stages of development. Some royalties may never pay off, but a few successful mines can compensate for the rest.

To illustrate, Franco Nevada, Wheaton Precious Metals, and others boast expansive portfolios spanning exploration to production-stage assets. These companies rely on the operators to replace reserves, expand resources, and keep the royalties flowing—tasks the royalty company doesn’t pay for.

This diversification makes royalty companies more like precious-metal-focused financial institutions than mining firms. Their assets grow not through drilling but through smart acquisitions and portfolio management.

The Trade-Off: Yield vs. Growth

Despite their steady cash flows, royalty companies aren’t known for high dividend yields. The top six royalty companies (market caps above $2 billion) average just 1.23% in total yield, trailing the S&P 500.

Why? Because royalty companies prioritize reinvestment. Their portfolios include exploration and development-stage assets that could drive future growth. While this approach has limited short-term returns, it positions these companies to capitalize on long-term gold price trends.

For example, Franco Nevada, the largest royalty company, faced challenges in 2023 when Panama temporarily shut down the Cobre Panama mine, impacting 25% of Franco’s revenue. Yet the company’s diversified portfolio and strong gold market allowed it to recover quickly and regain investor confidence; partially thanks to a dividend bump for shareholders.

Royalty Companies vs. Producers: Who Wins?

Over the past year, royalty companies have underperformed gold producers. Producers saw an average stock price gain of 40.85%, compared to 23.19% for royalty firms. But royalty companies offer unique advantages:

Lower risk: They’re insulated from mining costs and operational risks.

Steady returns: Even if a mine struggles, royalties come off the top.

However, royalty companies are not immune to geopolitical risks.

Smaller Players with Big Potential

The royalty sector isn’t just about giants like Franco Nevada or Wheaton. Smaller royalty companies offer higher growth potential, combined with greater risk.

Some smaller players boast impressive portfolios and yields far exceeding their larger peers. One, generating nearly as much revenue as Osisko and Sandstorm combined, outperformed the big names over the past year. Another, despite strong EBITDA, has seen its stock price slump, presenting a potential value opportunity.

Stay tuned, I will be spotlighting these two under-the-radar royalty companies that in my view have the perfect setup for this market.

Information for this story was found via the sources and company filings. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Great article!